Compass, which allowed me to win the Mind your money award , aims to improve the financial literacy and trust in banks of the 87% of family-owned SMEs in the UK. The service is a chargeable banking platform that helps family-owned SMEs to work toward a more sustainable future, with both online and offline interactions to address key barriers to SME-bank interaction, namely trust, financing options, and strategic goals.

The research took place in London, and was done interviewing a set of Small and Medium Businesses, and took into consideration all the pain points that are historically affecting SME’s around the UK.

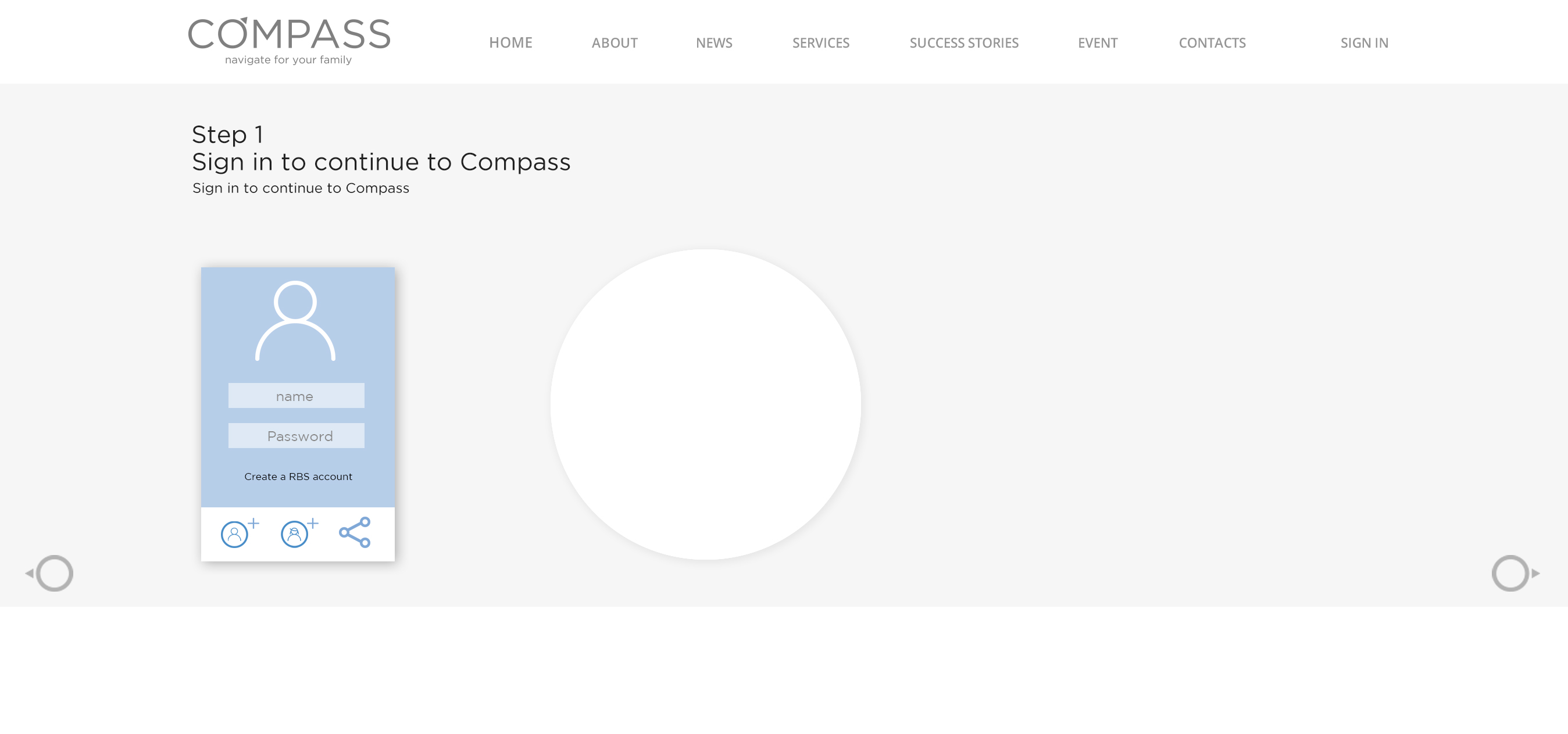

The first step is to sign up and add all your family members. This will allow the bank to gather as much data as possible, in order to give the best possible output to the user.

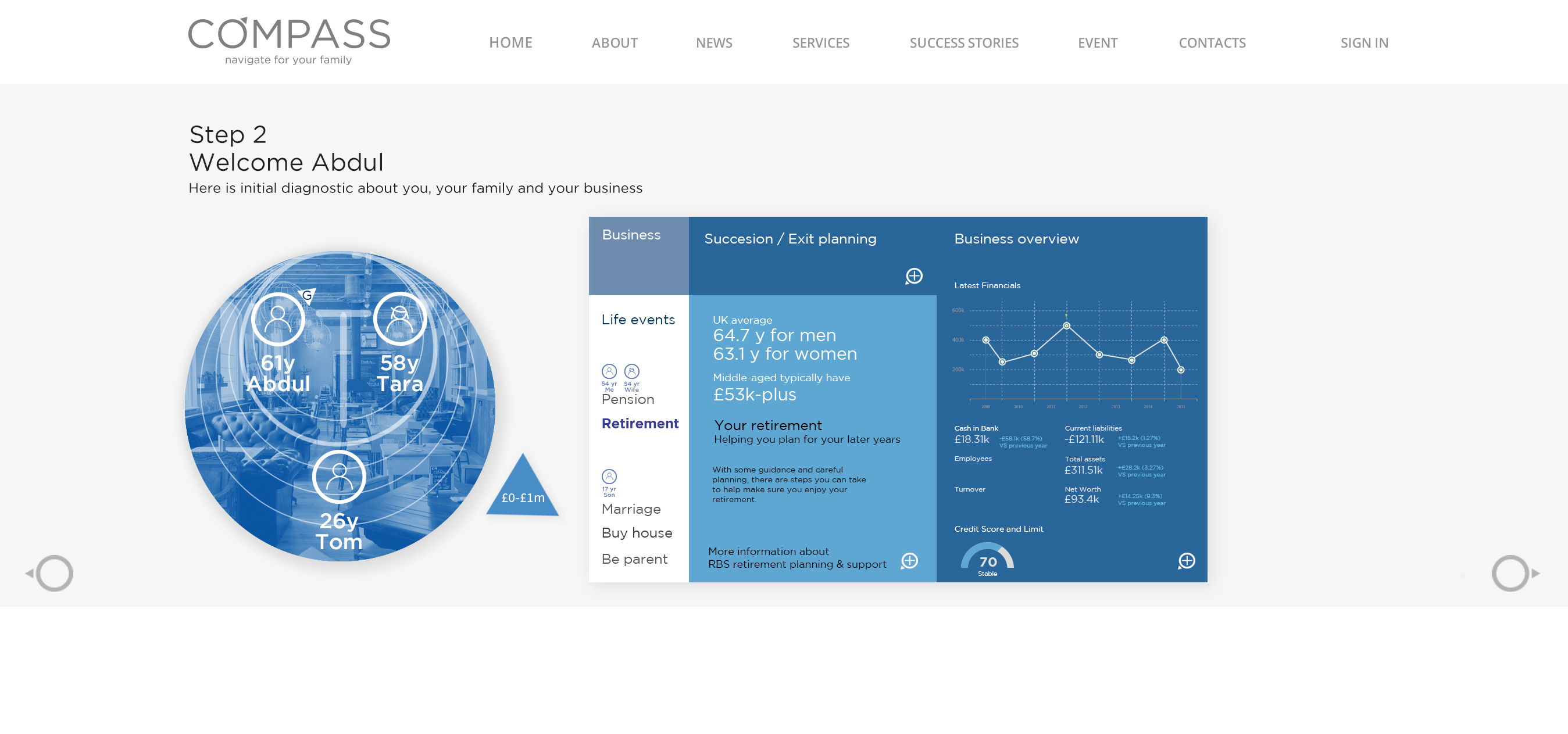

After that, as a second step, we would show the family dashboard using the previously inputted data. This dashboard serves as a reminder and a constant help to the SME’s owners so that they can try to be proactive about their next steps. Giving them average data for retirement and help sections to know more.

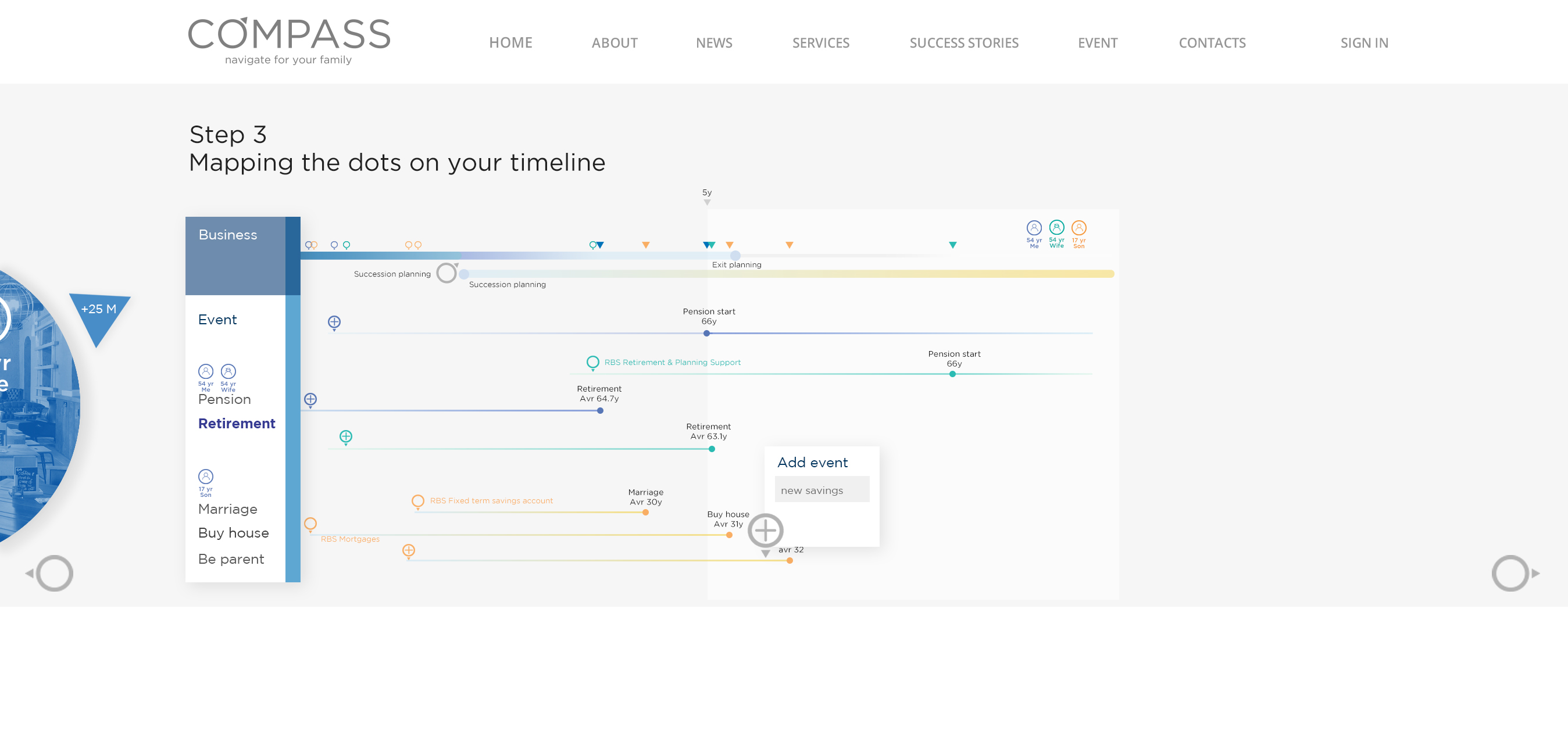

The third step is a Journey Map where the user can add events and map all the dots from his family timeline. This can give a good overview of what might happen in the soon future and create awareness.

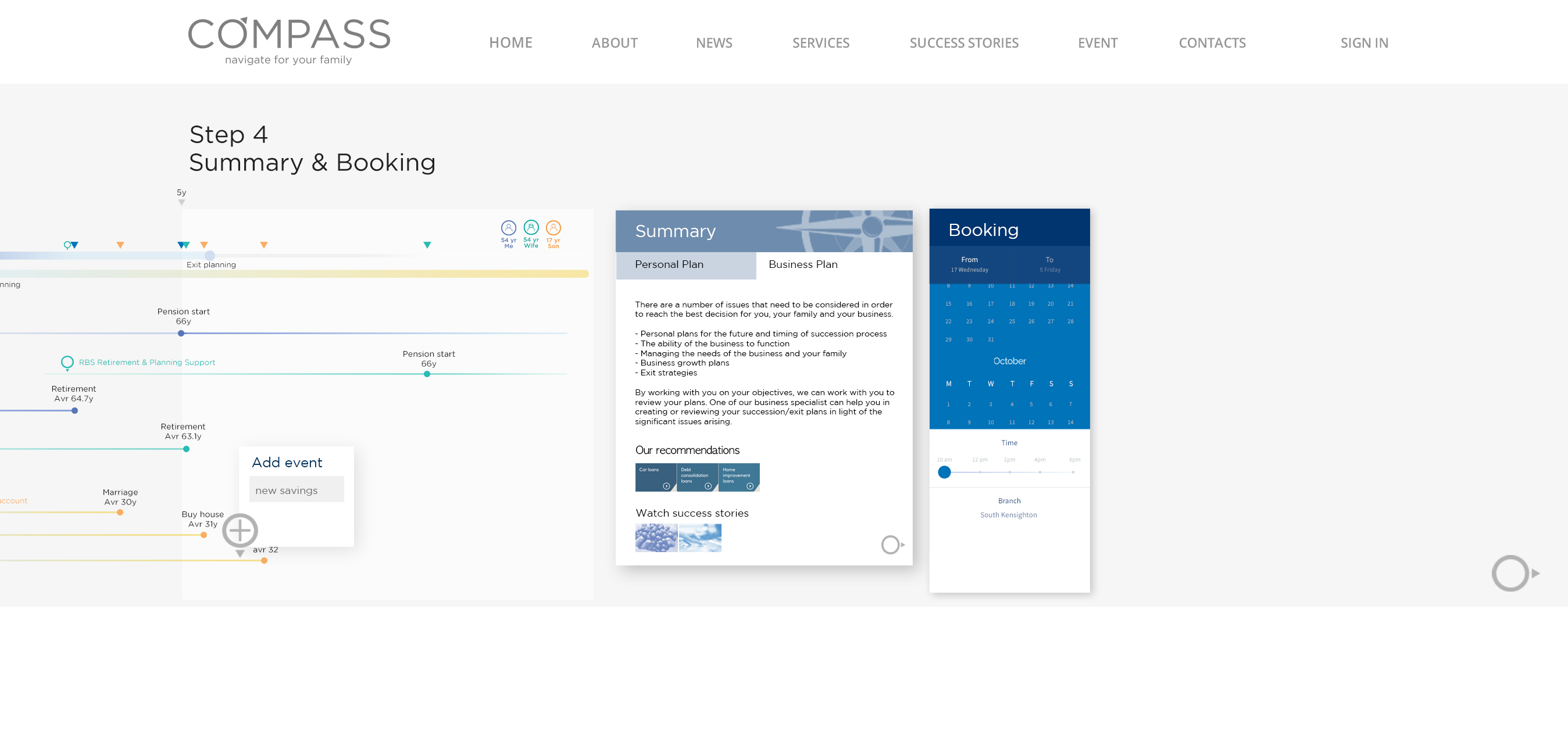

The final step is a summary view, where the user can check his Personal Plan as well as his Business Plan. We would recommend our Services and Help sections based on the data received, aiming to cross sell and up sell our products and services while helping our customer to improve his stability.

The Booking section is also something we thought of to help gain trust and have our 1 to 1 syncs where the customer can walk together with a designated counselor.